Russia's tank losses surge: over 3,600 tanks lost in 2024

In 2024, Ukrainian forces inflicted heavy damage on Russian armoured units, reportedly destroying or damaging over 3,000 tanks and nearly 9,000 other armoured vehicles. This high loss rate raises concerns about Russia’s ability to cope with such losses in the medium term, especially as its defense industry faces increasing strain.

Data from the Ukrainian General Staff indicates that from January 1, 2024, to January 1, 2025, Ukrainian forces destroyed 3,689 tanks, 8,956 infantry fighting vehicles [IFVs], 13,050 artillery pieces, and 407 air defense systems.

These numbers show ongoing damage to Russian military equipment over the year. Such substantial losses have diminished Russian combat capabilities and put pressure on their logistics and repair systems, making it harder for them to stay ready for operations.

The worst Russian losses happened during heavy offensives in Donetsk Oblast in September and October 2024. During this period, Russia reportedly lost 197 tanks, 661 armoured personnel carriers (APCs), and 65 large artillery systems. These losses grew worse in June and July, when Russian forces launched repeated mechanised attacks in the western Donetsk Oblast. Many of those attacks ended in failure, with major vehicle losses on open terrain.

The high number of failed assaults indicates that Russia is attempting to reclaim territory, but this effort comes at a significant cost. Yet, the growing cost of equipment has raised questions about how long Russia can sustain such tactics.

British IISS

Military analyst Kostyantyn Mashovets warned in early 2024 about the limits of Russia’s tank production capacity. He noted that Russia can only build or modernise approximately 250–300 tanks annually and repair a similar number.

That figure falls far short of Ukraine’s claim of destroying 3,600 Russian tanks in 2024 alone. This imbalance shows a serious gap in Russia’s defence industry under long-term conflict conditions. The British IISS supported this concern, noting Russia could rely on older stocks—but not indefinitely. As of early 2024, IISS said Russia might manage current losses until 2026 by refurbishing stored vehicles.

However, many older tanks have been in poor storage, reducing their battlefield reliability and readiness. Satellite images and open-source analysts tracked reductions in Russia’s tank and vehicle reserves. By late December, Russia reportedly had 47% of its pre-war tanks and 45% of its APCs still stored. Only 52% of infantry fighting vehicles (IFVs) remained in reserve, showing growing depletion.

Sustainability of Russian forces

Newer tanks like the T-90 and T-80 are now widely deployed, while older models are pulled from long-term storage. Many older tanks have deteriorated after years of exposure to poor conditions. This growing reliance on outdated gear shows the challenges Russia faces in rebuilding its forces amid constant losses.

These diminishing reserves and increasing loss rates, nearly triple those seen in the earlier years of the conflict, indicate a crucial turning point. The IISS’s early 2024 estimate suggests that Russia might be able to maintain its armoured vehicle losses until 2025, but this assessment may now be less valid.

The sustainability of Russian forces’ military efforts is increasingly under question as they face the pressing challenge of replenishing their diminishing armoured fleets. The long-term strategic implications for Russia are significant, as ongoing losses at this level suggest the possibility of broader repercussions. The scale may greatly weaken its power projection and control of contested areas.

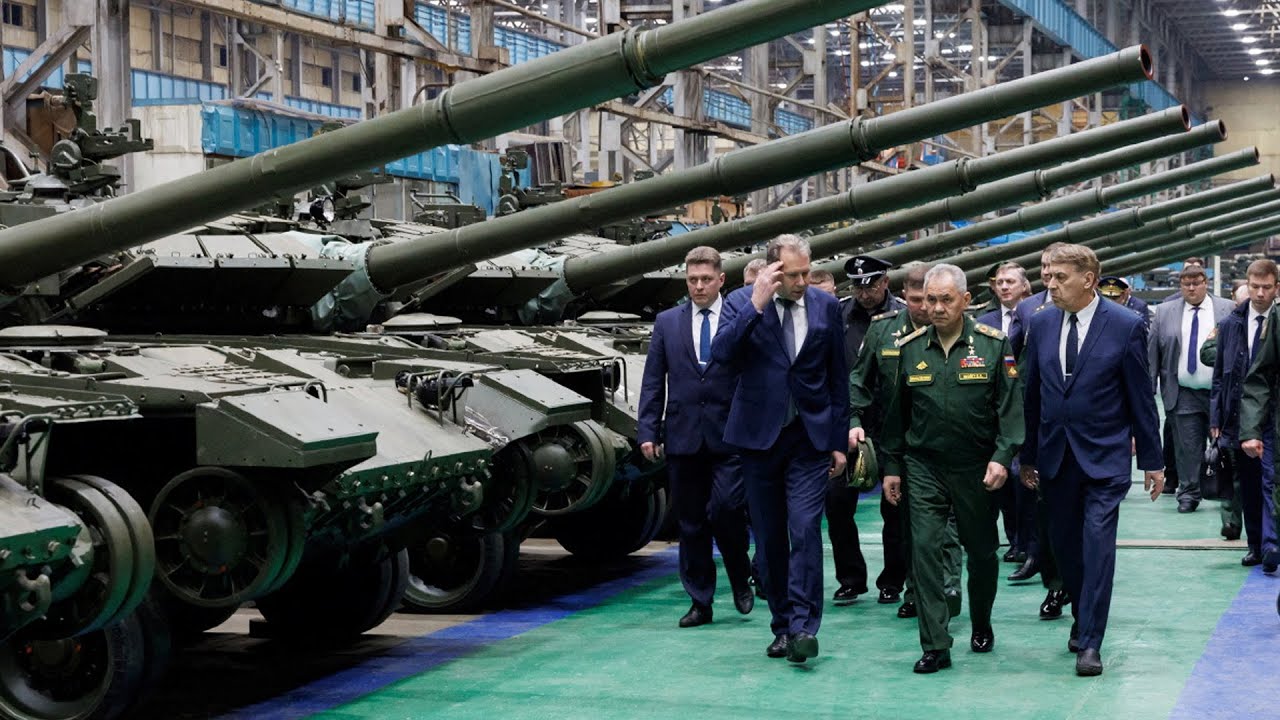

Omsk Transport Machine-Building Plant

Russia’s defence industry is currently under pressure, which may soon have broader economic and political implications. To boost production under sanctions, Moscow may shift resources from other vital sectors, worsening domestic issues.

As the war continues, Ukraine could gain momentum if it maintains high attrition rates and receives steady allied support. Due to the massive loss of armoured vehicles on the battlefield, observers are closely monitoring Russia’s tank factories.

These factories are essential for replacing destroyed tanks and restoring depleted armoured units. Russia’s main tank production sites include Uralvagonzavod, Omsk Transport Machine-Building Plant, and the Kirov Plant in Saint Petersburg.

Each factory plays a critical role in producing or upgrading the Russian Army’s armoured fleet. Uralvagonzavod in Nizhny Tagil is the world’s largest tank manufacturer and Russia’s primary source for main battle tanks.

It produces the T-90 series, including the T-90A and the more advanced T-90M variant. The T-90M offers improved protection, better firepower, and modern fire control systems for battlefield superiority. Besides the T-90, Uralvagonzavod also builds Russia’s next-generation tank—the T-14 Armata. The T-14 Armata features advanced systems but remains in low production due to high costs and funding problems.

Uralvagonzavod, Omsktransmash, and the Kirov Plant

The Omsk Transport Machine-Building Plant, often called Omsktransmash, focuses on heavily armoured vehicles like the T-80 series. The T-80, first developed in the late Soviet period, has seen various improvements, leading to models like the T-80BVM. This upgraded version has better armour, a new fire control system, and is effective in harsh conditions, which makes it suitable for places like Siberia.

OmskTransmash continues to modernise older T-80s to meet the BVM standard to prolong their service and improve battlefield performance. The Kirov Plant in Saint Petersburg, known for producing the KV and IS tank series during World War II, now focuses mainly on maintaining and modernising current armoured vehicles. This plant supports Russia’s armoured vehicle strategy by upgrading older tanks like the T-72 to T-72B3 and T-72B3M models.

These upgrades feature new fire control systems, improved engines, and better armour, making the older tanks relevant in combat. Despite these initiatives, these factories face limitations from factors like international sanctions, logistical issues, and ageing facilities. The total output of new and upgraded tanks from these sites is about 250 to 300 units a year, which is far less than needed to replace losses in Ukraine.

Furthermore, relying on outdated Soviet designs complicates Russia’s efforts to deploy modern armoured forces. As the conflict persists, the strain on these production facilities will likely grow, with the Kremlin seeking to boost output despite existing constraints. The ability of Uralvagonzavod, Omsktransmash, and the Kirov Plant to meet these demands will be crucial for the long-term sustainability of Russia’s armoured vehicle capabilities.

References

- Ukrainian General Staff Reports on Russian Military Losses

URL: https://www.mil.gov.ua/en/ - International Institute for Strategic Studies (IISS) Analysis on Russian Defence Capabilities

URL: https://www.iiss.org/ - Detailed Overview of Russian Tank Production Facilities and Capabilities

URL: https://www.defensenewstoday.info/