US–Pakistan Energy Partnership: Export Powerhouse

Pakistan’s energy story is changing fast, yet the gap remains wide. Domestic finds are rising, while import bills still strain the economy. A targeted energy partnership between the US and Pakistan could transform potential into actual production and then into exports.

Why Pakistan Needs an Energy Reset

For years, Pakistan has relied on imported fuels to run industry and transport. The petroleum import bill reached US$15.16 billion in FY2023–24, with some estimates as high as $16.91 billion. Therefore, every additional local barrel reduces outflows and strengthens resilience. A US-Pakistan energy partnership can accelerate that shift.

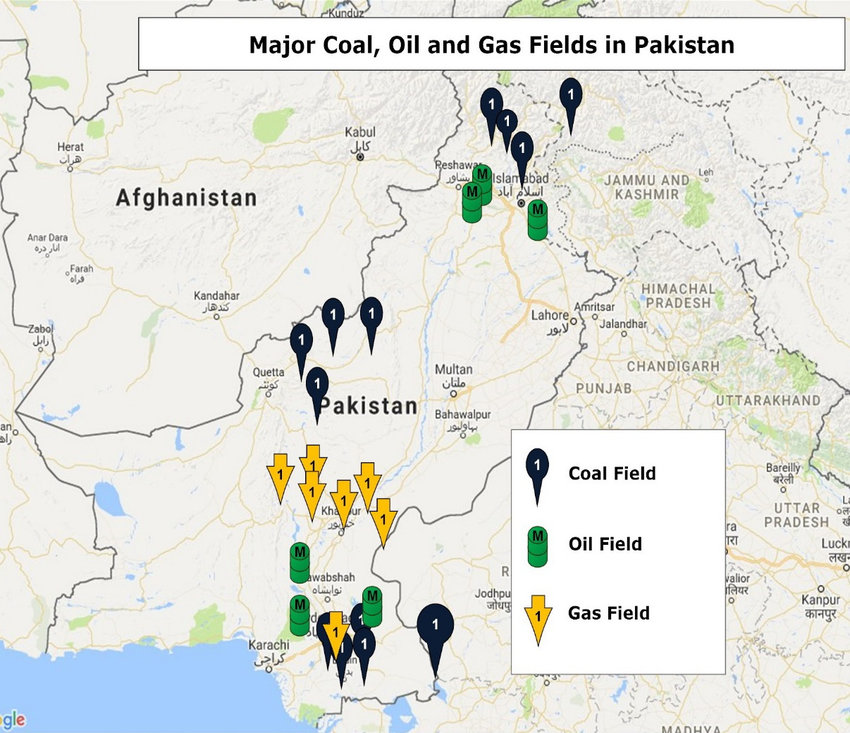

Reserves Are Rising, but the Gap Persists

By December 2024, proven oil reserves stood near 238 million barrels, up 23% from about 193 million a year earlier. This rise is modest by global standards, yet it signals latent potential. However, production still trails demand, so imports endure. Here, a US-Pakistan energy partnership offers capital, technology, and scale.

Shale Plays: Sembar and Ranikot, Lower Indus

Pakistan ranks high for shale prospectivity. The EIA indicates up to 9 billion barrels of technically recoverable shale oil and around 105 tcf of shale gas, largely in the Sembar and Ranikot formations. These are geological potentials, not proven reserves. Even so, a phased plan and a US-Pakistan energy partnership could unlock them.

Costs, Technology, and Timelines

Shale requires advanced drilling, completion, and data workflows. Industry estimates point to at least $5 billion to launch pilots and prove commerciality. Consequently, well sequencing, pad design, and water logistics matter. With US fracking know-how, a US-Pakistan energy partnership could compress learning curves and shorten timelines.

Offshore Indus: The Next Frontier

A multi-year seismic program in early 2024 mapped promising hydrocarbon structures in the offshore Indus Basin. Although early, these leads broaden the option set and diversify risk. If exploration succeeds, offshore output could stabilize supply. Crucially, a US-Pakistan energy partnership can bring deepwater experience and risk capital.

Capital, Technology, and the SIFC Advantage

Policy clarity unlocks investment. Pakistan’s Special Investment Facilitation Council (SIFC) has streamlined approvals, notably in renewables and mining. Moreover, Pakistan’s mineral wealth—valued between $6 and $8 trillion—spans copper, lithium, and rare earths. These inputs feed US clean-energy supply chains. Therefore, a US-Pakistan energy partnership aligns energy security with strategic materials.

Trade, Tariffs, and Momentum

The United States remains Pakistan’s largest export market, at roughly 17% of exports. American firms already invest across consumer goods, ICT, renewables, and finance. Additionally, high-level talks in July–August 2025 produced a trade pact to develop oil reserves and reduce bilateral tariffs. Notably, President Donald Trump suggested future exploration could position Pakistan as a regional exporter. That rhetoric, paired with policy, can anchor a US-Pakistan energy partnership.

A Practical Roadmap for Export Ambitions

To move from importer to exporter, Pakistan needs a bankable sequence of reforms and projects. The following steps prioritize proof, scale, and infrastructure. Each step benefits from a US-Pakistan energy partnership.

1st Phase: Prove the Basins

- Launch shale pilots in the Lower Indus Basin with tight appraisal loops.

- Use US completion design, petrotechnical modeling, and real-time drilling analytics.

- Incentivize data sharing and standardized reporting to derisk capital.

2nd Phase: Scale with Midstream

- Expand gathering lines, gas processing, and storage; reduce flaring and methane intensity.

- Reform gas pricing to encourage investment and improve offtake certainty.

- Mobilize blended finance through DFC, EXIM, and private equity under a US-Pakistan energy partnership.

3rd Phase: Export Pathways

- Add pipeline debottlenecking and LNG/liquids handling where viable.

- Target petrochemical value additions to retain margins at home.

- Structure a long-term offtake with regional buyers to stabilize cash flows.

Enablers: Policy, ESG, and Security

- Lock in stable fiscal terms and ring-fence contracts from retroactive changes.

- Enforce ESG standards, cut methane, and digitize monitoring to meet global buyers’ demands.

- Coordinate security for field crews and offshore assets to lower risk premiums.

Security, Stability, and Regional Upside

Energy stability reduces macro-volatility and supports defense-industrial planning. Moreover, diversified supply underpins regional credibility. With better cash flows, Pakistan can fund critical infrastructure and industrial upgrades. Thus, a US-Pakistan energy partnership strengthens both economic and strategic footing.

From Dependence to Resilience

Pakistan is not resource-poor; it is resource-underdeveloped. Proven reserves are rising, shale potential is vast, and offshore leads are encouraging. With policy certainty, modern technology, and patient capital, the country can pivot from chronic dependence to durable self-sufficiency. If executed well, a US-Pakistan energy partnership can help transform Pakistan into a resilient energy player—and eventually, an exporter.

References

- U.S. Energy Information Administration – World Shale Resource Assessments: https://www.eia.gov/analysis/studies/worldshalegas/

- State Bank of Pakistan – External Sector and Trade Statistics: https://www.sbp.org.pk/

- Special Investment Facilitation Council (SIFC) – Investment Facilitation: https://sifc.gov.pk/

- Ministry of Energy (Petroleum Division), Government of Pakistan: https://www.mepd.gov.pk/